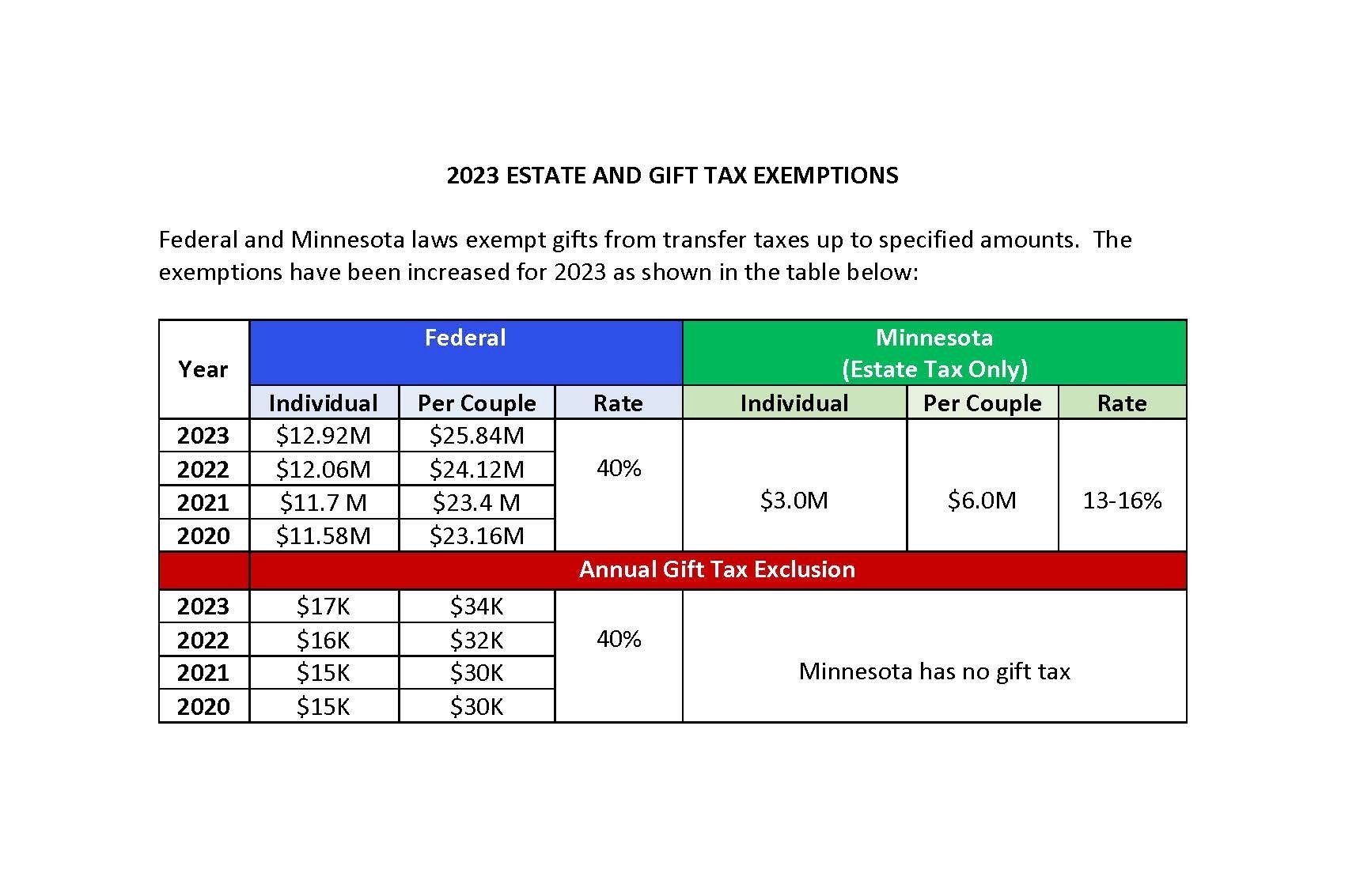

Estate Gift Tax Exemption 2025. Gift tax, generation skipping transfer tax, and estate tax exemptions (unified) single: For context, the 2025 gift tax exemption is $17,000.

For people who pass away in 2025, the exemption amount is $13.61 million (up from the $12.92 million 2025 estate tax exemption amount). This is the dollar amount of taxable gifts that each person can.

Understanding 2025 Estate, Gift, and GenerationSkipping Transfer Tax, Gift and estate tax exemptions for 2025. For individuals who pass away in 2025, the exempt amount from federal estate tax is projected to be $13.61 million, up from $12.92 million for estates of.

Federal Estate and Gift Tax Exemption set to Rise Substantially for, For individuals who pass away in 2025, the exempt amount from federal estate tax is projected to be $13.61 million, up from $12.92 million for estates of. Gift and estate tax exemptions for 2025.

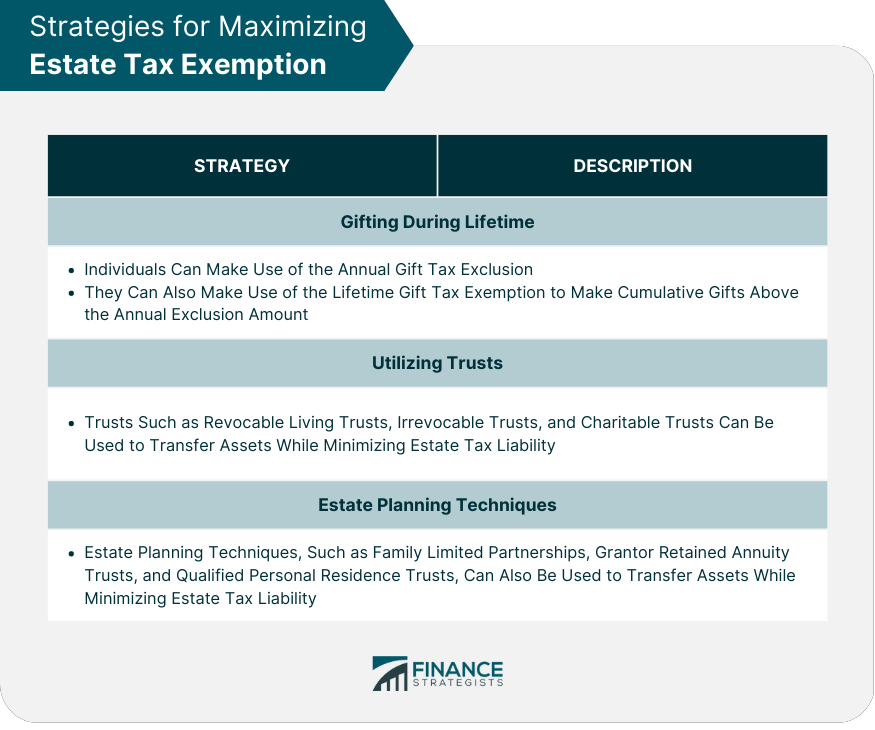

Discover The Latest Federal Estate Tax Exemption Increase For 2025, What is considered a gift? The simplest strategy is a direct gift of cash, securities or other assets with a value up to the lifetime exemption.

2025 Estate and Gift Tax Exemptions — Provenance Law PLLC, What can be excluded from gifts? For individuals who pass away in 2025, the exempt amount from federal estate tax is projected to be $13.61 million, up from $12.92 million for estates of.

.jpg)

2025 Estate and Gift Tax Exemptions Littman Krooks LLP, The gift and estate tax exemption has increased to $13,610,000 per individual in 2025. The exemption from gift and estate taxes is now just above $13.6 million, up from about $12.9 million last year.

Estate Tax Exemption Definition, Thresholds, and Strategies, For individuals who pass away in 2025, the exempt amount from federal estate tax is projected to be $13.61 million, up from $12.92 million for estates of. Gift tax, generation skipping transfer tax, and estate tax exemptions (unified) single:

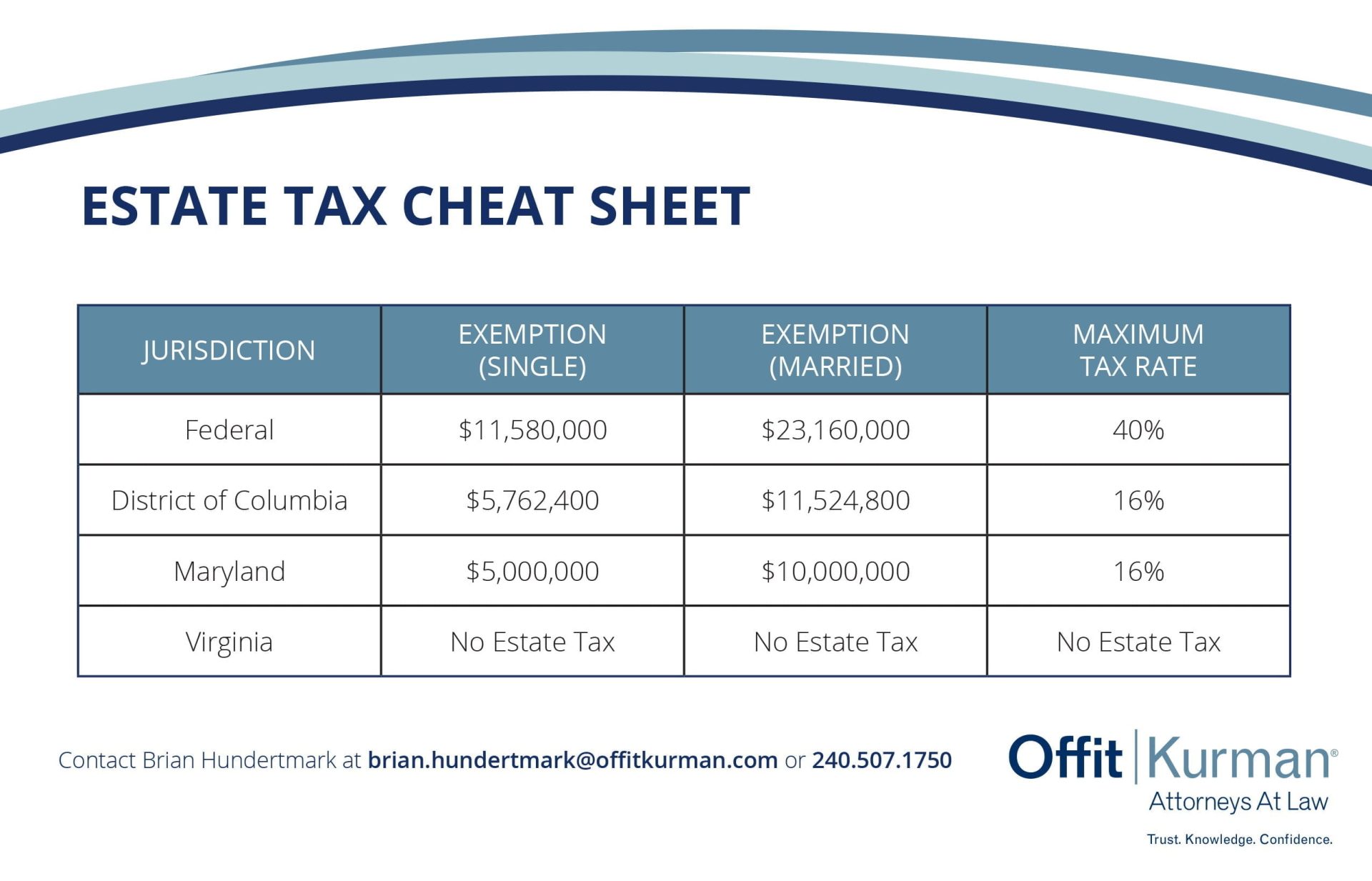

2025 Estate and Gift Taxes Offit Kurman, First, investors can (1) diversify their tax treatments. How many annual exclusions are available?

annual gift tax exclusion 2025 irs Trina Stack, This is the dollar amount of taxable gifts that each person can. If they make good use of a portability election, a married couple could.

Why Now May be the Right Time for Estate Tax Planning, For individuals who pass away in 2025, the exempt amount from federal estate tax is projected to be $13.61 million, up from $12.92 million for estates of. The gift and estate exemption amount in 2025 is $12.92 million.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, (2) certain gifts related to a person’s health. The federal lifetime estate and gift tax exemption will sunset after 2025.

The gift and estate tax exemption is $13,610,000 per individual for gifts and deaths occurring in 2025, an increase from $12,920,000 in 2025.